Serving Central Texas for Over 40 Years

We have been actively serving the Central Texas real estate community, under one name or another, for over 40 years through good times and bad. We specialize in the leasing, brokerage and management of commercial and investment properties. Our clients are assured of the highest levels of customer service and integrity. For more about us, please check out our About page.

Regardless of your requirements we are prepared to help provide the solutions that meet your needs. Please let us know how we may be of service to you. For our current listings, please see our FOR SALE PAGE, our FOR LEASE PAGE, and our NEEDS PAGE. However, please do call, because we may have some items not listed. 512.527.9600

Thanks for your interest in Captex Commercial Properties, we look forward to hearing from you soon.

Featured Properties For Sale

101 Berry Ln, Georgetown

2.252 acres Outside Georgetown ETJ Jonah water, Septic $695,000.00 ($7.08 psf) Download property PDF brochure 101 Berry Lane Georgetown Oops, sorry, you just missed it. CLOSED

2400 E. Rancier Ave

This property is 3.2 Acres in the Ft. Hood Area. It is a Ground Lease/Build To Suit Download Property PDF brochure: 2400 E. Rancier Ave

Featured Properties For Lease

Texas Star Plaza (Killeen) – 3,970 Sq. Ft. Professional Offices

Texas Star Plaza 2300 E. Rancier Ave. Killeen, Texas 78654 Texas Star Plaza is an L-shaped neighborhood retail center totaling 17,881 sqft, located at 2300 E. Rancier Avenue in Killeen, Texas. The property offers strong street presence, convenient access, and ample surface parking. Positioned in a market anchored by Fort Hood, the center benefits from…

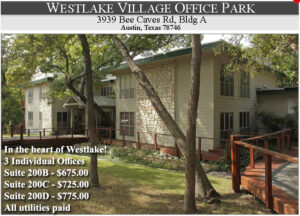

3939 Bee Caves Rd. – 3 Individual Offices

Westlake Village Office Park 3939 Bee Caves Rd, Building A Austin, TX 78746 3 Individual Offices available in the heart of Westlake! Suite 200B – $675.00 Suite 200C – $725.00 Suite 200D – $775.00 All Utilities Paid Please click here for more information.

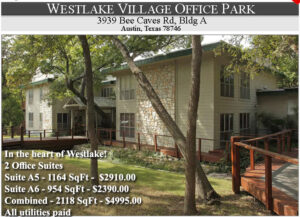

3939 Bee Caves Rd. – 2 Office Suites

Westlake Village Office Park 3939 Bee Caves Rd, Building A Austin, TX 78746 Executive office suites available in the heart of Westlake! Suite A5 – 1164 SqFt – $2910.00 Suite A6 – 954 SqFt – $2390.00 Combined – 2118 SqFt – $4995.00 All Utilities Paid Click here for more info, including floor plan.

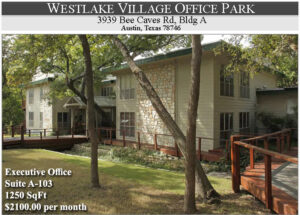

3939 Bee Caves Rd. – 4 Office Suite

Westlake Village Office Park 3939 Bee Caves Rd, Building A Austin, TX 78746 Executive office available in the heart of Westlake! Suite A103 4 Office Suite 1250 SqFt $2100.00 per month All Utilities Paid Click here for floor plan.

13279 Pond Springs Road #2

13279 Pond Springs #2 Austin, Texas 78729 1,012 sq ft 4 Offices, Open office Ample parking $2,150.00 per month plus electric Brochure of 13279 Pond Springs # 2 LEASED

13279 Pond Springs Road, #3 & #4

2,024 Sq. Ft. 10+ Offices, Open area, 2 Rest Rooms, Kitchen, Ample Parking $4,200 per month plus electric Download brochure for 13279 Pond Springs Rd, # 3&4 LEASED

Texas Star Plaza 2300 E Rancier, #108

2,328 sqft Retail/office, 20K+ VPD Pylon sign 2 miles from Fort Cavasos (formerly Ft. Hood) $3,925 plus utilities Download property pdf tsp_108

2400 E. Rancier Ave

This property is 3.2 Acres in the Ft. Cavasos Area. It is a Ground Lease/Build To Suit Download Property PDF brochure: 2400 E. Rancier Ave